Is the Housing Market in a Recession?

As we make our way into 2023, we find ourselves reflecting on the twists and turns the housing market faced in 2022. The real estate market shifted dramatically in the second half of 2022 and this lead many to compare current matters to those that occurred in 2008. First order of business is to define the word recession. As of right now, our general economy is not in a recession but the housing market has been in one since the summer of 2022. The Housing Wire reminds us that when we see the following four things, this is when we can consider the housing market in a recession.

Sales Fall: The housing demand has fallen this year.

Production Falls: Even with the backlog of homes, housing permits have started to fall.

Jobs are Lost: Significant layoffs have taken place throughout the housing sector.

Incomes go Down: Transaction volume has decreased leading to a falling general income.

Just because home prices are up, we still find ourselves in a housing recession.

Where’s all of the Inventory?

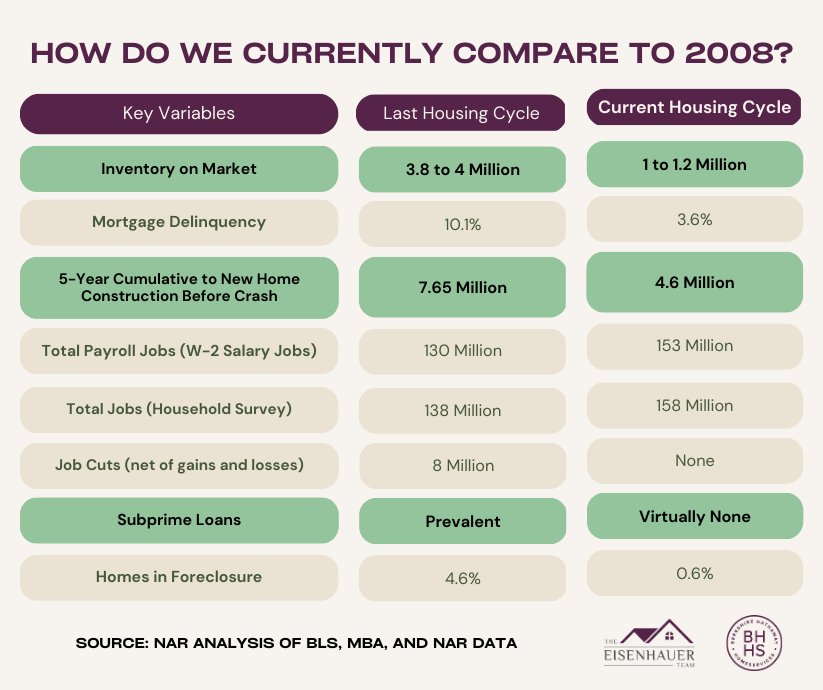

The housing inventory we see today is the main difference between 2008 and now. The housing inventory today is around 1 to 1.2 million whereas in 2008 we saw around 3.8 to 4 million. This is a major difference.

We have started 2023 with the second-lowest inventory in history. 13 years of under development, stemming from 2008, is the cause for this extensive housing shortage. The demand for homes is only continuing to grow while builders find themselves behind on the construction of new houses.

Where do you Stand Financially?

Referring to the chart above, we can see the significant difference between the housing credit today versus 2008. We saw a rise of foreclosures and bankruptcy back then, and now we are recording the best housing credit profiles in US history because of the 2005 bankruptcy reform laws and the 2010 Qualified Mortgage laws.

Well as homeowners credit looking excellent, over 40% of homes in America don’t have a mortgage. When looking at the credit and debt side of the equation, the housing market looks a lot different in this recession because there is a lot of nested equity.

The Bottom Line…

Are we currently facing a housing recession? Yes, but it is nothing like 2008. As a buyer, this may be the chance you have been waiting for.